Navigating Between Innovation and Standardization: A Guide to Engaging the Millennial Market in Banking & Finance - Insights From ABBYY

Navigating Between Innovation and Standardization: A Guide to Engaging the Millennial Market in Banking & Finance - Insights From ABBYY

Innovation vs. commoditization: understanding millennials in banking & financial services

September 14, 2017

My generation of 2.5 billion millennials around the world will soon have the collective capacity to generate $1.4 trillion of purchasing power by 2025 . There are 92 million millennials in America today , the biggest generation in US history, even more than the Baby Boomers. It’s obvious why banks and financial service institutions are keeping a sharp eye on the millennial demographic.

One of the largest generations in history is about to move into its prime spending years. Millennials are poised to reshape the economy; their unique experiences will change the ways we buy and sell, forcing companies to examine how they do business for decades to come.

Goldman Sachs

While the possibilities are exciting, the two most common ages in 2016 were 19 years old (4,585,234) and 50 years old (4,660,295) , basically millennials and Baby Boomers.

Baby Boomers were once considered the technological future of their generation’s time. Their need to go inside a branch dwindled as wide-spread innovation began with the Automated Teller Machine (ATM), creating 3.5 million ATMs around the world . However, this pales in comparison to the 4.77 billion global mobile phone users in 2017 and how millennials interact with their finances today:

50% of millennials transfer money digitally, and that 50% are looking spend $1.4 trillion solely on home purchases by 2018

To stand out, banking and financial services institutions must overcome the commoditization of app-based services and further innovate to provide their clients even better and more personalized premium self-service experiences on mobile devices.

Innovation vs. commoditization: why automation doesn’t fix everything

My house lights and fans are automated through Amazon’s Alexa. My security cameras are automated through the cloud. My payments are fully automated through my mobile apps. Automation has embedded itself in our lives, and the idea of visiting a bank branch is an antiquated thought.

For millennials, innovative bank or financial service performance is less about the physical branch, and more about premium self-service. We expect 24/7 real-time access and service from the organizations and providers we engage with. Innovation goes beyond the simple automation of processes in the back office, by bringing the front office directly to mobile devices and letting millennials process things on their own time.

Intelligent capture drives cost reduction & improved customer services

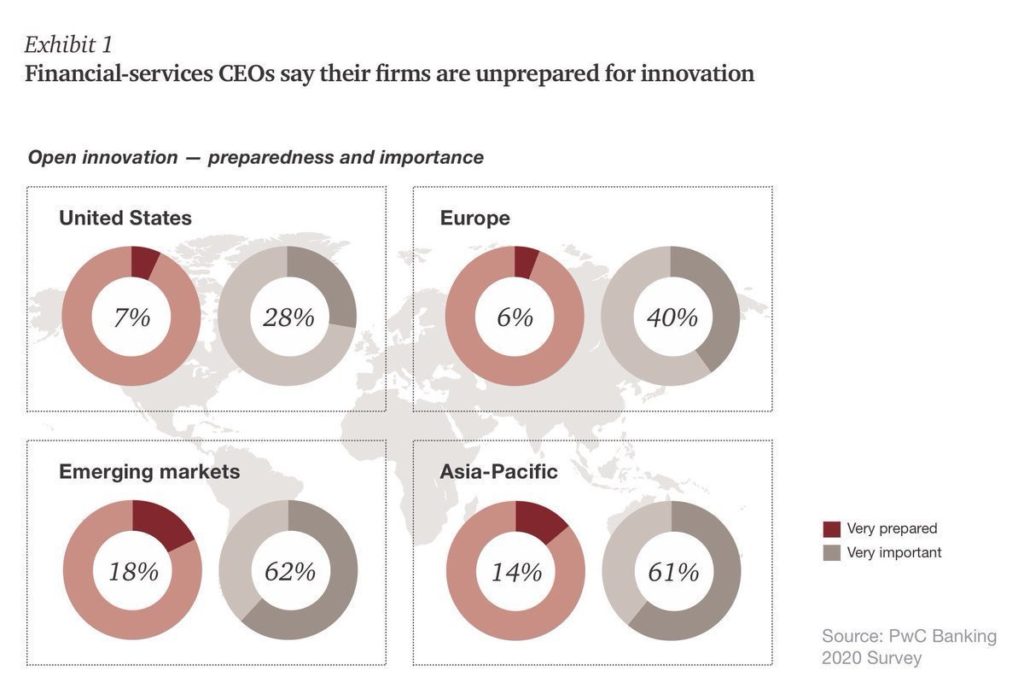

Sadly, PwC notes that only 7% of US-based CEOs consider themselves prepared for innovation :

Banks and financial services institutions are under increasing pressure to contain costs and improve service quality, but that is difficult to do when the existing infrastructure is dependent on outdated, paper-based workflows. Intelligent data capture, document classification, and unstructured content extraction solutions on mobile, on-site, and in the cloud, enable millennials in real-time.

Author’s note:

I am currently 28 and my parents are 55. This places me in the millennial bracket (born 1980-1999) and my parents in the Baby Boomers generation (born 1946-1964), both the two largest segments of the US population as seen in this graph from CNN Money .

Derek Gerber

Like, share or repost

Share

Subscribe for blog updates

First name*

E-mail*

Сountry*

СountryAfghanistanAland IslandsAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntarcticaAntigua and BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelgiumBelizeBeninBermudaBhutanBoliviaBonaire, Sint Eustatius and SabaBosnia and HerzegovinaBotswanaBouvet IslandBrazilBritish Indian Ocean TerritoryBritish Virgin IslandsBrunei DarussalamBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongo (Brazzaville)Congo, (Kinshasa)Cook IslandsCosta RicaCroatiaCuraçaoCyprusCzech RepublicCôte d’IvoireDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland Islands (Malvinas)Faroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuernseyGuineaGuinea-BissauGuyanaHaitiHeard and Mcdonald IslandsHoly See (Vatican City State)HondurasHong Kong, SAR ChinaHungaryIcelandIndiaIndonesiaIraqIrelandIsle of ManIsraelITJamaicaJapanJerseyJordanKazakhstanKenyaKiribatiKorea (South)KuwaitKyrgyzstanLao PDRLatviaLebanonLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacao, SAR ChinaMacedonia, Republic ofMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesia, Federated States ofMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinian TerritoryPanamaPapua New GuineaParaguayPeruPhilippinesPitcairnPolandPortugalPuerto RicoQatarRomaniaRwandaRéunionSaint HelenaSaint Kitts and NevisSaint LuciaSaint Pierre and MiquelonSaint Vincent and GrenadinesSaint-BarthélemySaint-Martin (French part)SamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSint Maarten (Dutch part)SlovakiaSloveniaSolomon IslandsSouth AfricaSouth Georgia and the South Sandwich IslandsSouth SudanSpainSri LankaSurinameSvalbard and Jan Mayen IslandsSwazilandSwedenSwitzerlandTaiwan, Republic of ChinaTajikistanTanzania, United Republic ofThailandTimor-LesteTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States of AmericaUruguayUS Minor Outlying IslandsUzbekistanVanuatuVenezuela (Bolivarian Republic)Viet NamVirgin Islands, USWallis and Futuna IslandsWestern SaharaZambiaZimbabwe

I have read and agree with the Privacy policy and the Cookie policy .

I agree to receive email updates from ABBYY Solutions Ltd. such as news related to ABBYY Solutions Ltd. products and technologies, invitations to events and webinars, and information about whitepapers and content related to ABBYY Solutions Ltd. products and services.

I am aware that my consent could be revoked at any time by clicking the unsubscribe link inside any email received from ABBYY Solutions Ltd. or via ABBYY Data Subject Access Rights Form .

Referrer

Last name

Query string

Product Interest Temp

UTM Campaign Name

UTM Medium

UTM Source

ITM Source

GA Client ID

UTM Content

GDPR Consent Note

Captcha Score

Page URL

Connect with us

Also read:

- [New] Substitutes to MovieMaker in the Windows Realm for 2024

- [Updated] 2024 Approved Channel Visualization Selecting the Ideal Size and Placement for YT

- 2024 Approved Free Videography Starter Pack Openers & More

- Basics on Windows EXE/PE Files: An Overview

- DVDの完全安全コピー手順:Mac上で確実に守られた複製 - 不正行為無し、権利侵害せず

- Dynamic Discussions How to Make Your IG Stories Pop

- Expert Picks of the 15 Leading Free Video Converters for Seamless PC & Mac 4K Format Transformation

- How to play an MP4 on Samsung Galaxy F14 5G?

- In 2024, Best Practices for Free Clipart Use in Projects

- Most Popular Tweets of 2023 - Viewership Ranked

- Overcoming Crucial System Integrity Faults in Windows 11 - Now Solved!

- Resolving Kernel Security Check Violation and Blue Screen of Death in Windows 11: A Comprehensive Guide

- Unlocking Your DVD Player: Remove Region Locks for DVDs in Windows OS

- Title: Navigating Between Innovation and Standardization: A Guide to Engaging the Millennial Market in Banking & Finance - Insights From ABBYY

- Author: Mark

- Created at : 2025-01-03 21:07:54

- Updated at : 2025-01-09 21:15:17

- Link: https://some-guidance.techidaily.com/navigating-between-innovation-and-standardization-a-guide-to-engaging-the-millennial-market-in-banking-and-finance-insights-from-abbyy/

- License: This work is licensed under CC BY-NC-SA 4.0.